Phase I – “A Sure Thing”

I began “investing” in 2017 — though in reality, it was the kind of investing most people start with when they first discover what they think the stock market is: an adult’s gambling arena.

My first exposure was a handful of penny stocks a friend recommended. I was told they were a “sure thing”, backed by “promising data”, the source… his older brother. With no real understanding of this new world, and reassured by the promise of a “guaranteed winner”, I threw what little money I’d saved as a university student into several prospecting mining stocks.

I won’t lie — those first couple of weeks were a rush. Portfolio swings of ±10%, even ±20%, were common. I thought, “This investing business is easy!” Penny stocks felt like my golden ticket. Some days I made more than I did in a whole shift bartending. A couple more wins and maybe I’d never need another job again.

That fantasy came crashing down within a fortnight. Almost all my investments tanked. One company was even removed from the ASX for falsifying data. That position — now worth nothing — still sits in my brokerage account today as a stark reminder of what happens when you take risks without doing your own due diligence.

This loss felt personal — like a blunt message from the adult world telling me, “stay in your lane.” I sold out of all my positions, each one a painful hit, with the smallest loss still a brutal –86%. I shut down my brokerage account and didn’t open it again for two and a half years. The embarrassment ran deep; it wasn’t just money I’d lost, but confidence. Investing now felt like a complex, gated domain reserved for people smarter, richer, or better connected than me. So, I moved on — finishing uni, starting my career, and moving out with friends, quietly shelving the idea that I could ever succeed in the markets.

Phase II — A World on Pause

By March 23, 2020, the MSCI World Index had plunged 34%. Lockdowns were gripping the globe. Lives, businesses, entire economies—everything stood still. Sentiment wasn’t just down for markets—it tanked for the human spirit itself.

But as we now look back, 2020 turned into a kind of “once in a generation” moment for wealth building. By September of that year, the MSCI World had recouped its losses and pushed into record territory.

I didn’t buy during the crash—far from it. Yet that year reignited my investing journey. It marked my shift toward a much simpler, more resilient approach: buying the market through ETFs.

Since 2020, the ETF universe has doubled in size — a clear sign of a market in transformation. What started as a gradual shift before COVID has now become a global movement, reshaping how millions see — and invest in — the stock market.

But with this surge in ETFs came a new wave of confusion — and I was right there in the middle of it. I snapped up multiple funds that, in hindsight, could easily be called the “flavour of the month.” The result? A messy overlap in holdings that amplified my downside risk if the market turned. Thematic ETFs were everywhere — remember the lithium boom? We can’t forget the spectacular tech crash of 2022? I like to think I paid extra for a front-row seat to nearly every overhyped crash out there.

Phase III – Slowly Stacking

Enter my SlowlyStacking mindset! After the tech crash of 2022, my “buy every ETF” approach finally crumbled under the weight of overlaps and hype. Since then, I’ve adopted a more refined, long-term strategy: ditch the thematics, embrace diversification across core markets, and stack positions slowly over time.

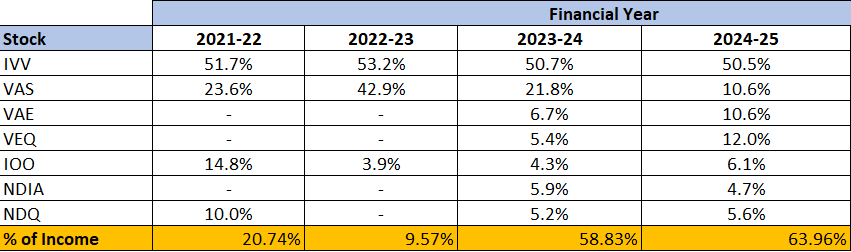

Just by looking at the table about you can see that I missed a huge opportunity not sticking to investing during the 2022 tech bear market. However, I learnt a valuable lesson that year, BLOCK OUT THE NOISE.

My focus is now on four major regions:

- USA: S&P500 (IVV)

- Australia: (VAS)

- Asia ex-Japan: (VAE)

- Europe: (VEQ)

These four areas combined cover roughly 85%-90% of the global market cap, thus reducing the risk of being overly concentrated in one country or sector. By steadily building these positions, I’m aiming for sustainable growth, rather than chasing whatever the latest hype trend may be.

The Slowly Stacking mindset has helped me block out the constant noise the market produces — from looming crash predictions to bursts of bullish hype. For years now, I’ve been able to dollar-cost average consistently, without feeling the need to check the price of lithium (or any other market fad) every week.

The result? My investing feels calmer, more predictable, and far less stressful. I know exactly what I’m buying, when I’m buying it, and why — freeing me from the urge to time the market or chase the latest narrative.